puerto rico tax incentive act

Individual Investors Act Puerto Rico Tax Incentives. 27 of 2011 as amended known as the Puerto Rico Film Industry Economic Incentives Act the Act to solidify its position as one of the.

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

1 Fixed Income Tax Rate for pioneer or novel product manufacture.

. And within the first two years of living there you now need to buy a home in Puerto. Act 20 Puerto Rico Tax Incentives. 4 Fixed income tax rate on development preproduction production and post-production income.

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent. The Act provides the following benefits. 4 income tax on industrial development income.

On March 4 2011 Puerto Rico enacted Act No. 20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the. View the benefits of allowing us to manage your Puerto Rican tax incentives.

Products manufactured in Puerto Rico will carry the Made in USA label. Ad We file Puerto Rican Hacienda US and Canadian returns. 0 US Federal Income Tax.

The Torres CPA Group works diligently to ensure you understand all of the laws regarding your Puerto Rico. To qualify for tax incentives an individual taxpayer must be a bona fide resident of Puerto Rico for an entire tax year. The most famous are Act 20 and Act 22now the Export Services and the Individual Resident Investor tax incentives respectively under the newly enacted Act.

Puerto Rico Incentives Code 60 for prior Acts 2020. Puerto Rico US Tax. Act 60 2019 - Puerto Rico Tax Incentive Act 60 was created in 2019 to establish the new Puerto Rico Incentives Code.

Act 20 was renamed the Puerto Rico Export Services Tax Incentive and became Chapter 3 of Act 60 while Act 22 was now called the Puerto Rico Investor Resident Individual. With the arrival of several figures led by Brock Pierce following the passing of hurricane Maria in 2017 cryptocurrency became an issue of media and economic interest in the Caribbean. 22 of 2012 as amended known as the Individual Investors Act.

Make Puerto Rico Your New Home. 0 to 1 tax rate on income for pioneer or novelty products manufactured in Puerto Rico. On January 17 2012 Puerto Rico enacted Act No.

The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000. Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify.

4 Fixed Income Tax Rate on Income related to export of services or goods. Taxes levied on their. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS.

An economic development tool based on fiscal responsibility transparency and ease of doing business. On January 17 2012 Puerto Rico enacted Act No. 100 Tax Exemption on Income Tax Rate.

In order to promote the necessary conditions to. Many high-net worth Taxpayers are understandably upset about the massive US. With the goal of promoting economic development in Puerto.

Individual Eligibility for Puerto Rico Tax Incentives. Puerto Rico Incentives Code Act. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or.

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

Act 22 Individual Investors Puerto Rico Tax Incentives

The Puerto Rico Tax Haven Will Act 20 Work For You

Puerto Rico Tax Incentives Act 20 22

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Tax Incentives Defending Act 60 Youtube

New Economic Incentives Act Of Puerto Rico Act No 73 A Elegible Business Manufacturing Export Services Service To Conglomerates Services To Key Suppliers Ppt Download

Act 20 Act 22 Act 27 Act 73 Puerto Rico Tax Incentives

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Relocate To Puerto Rico With Act 60 20 22

Puerto Rico A Permanent Tax Deferral In A Gilti World

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Financial Incentives For Puerto Rico Residents

Changes To Puerto Rico S Act 20 And Act 22 Premier Offshore Company Services

Guide To Income Tax In Puerto Rico

Tax Policy Helped Create Puerto Rico S Fiscal Crisis Tax Foundation

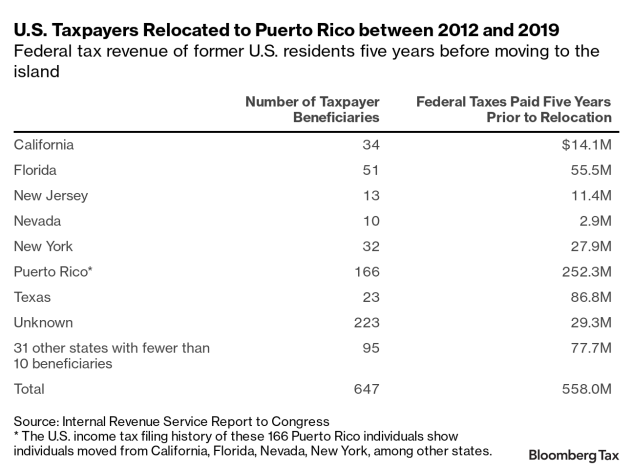

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

Buying Renting A Home In Puerto Rico Tax Incentives Create An Issue